Small businesses and large institutions use VAT as a fundamental component for their financial operations including print services. Under UK VAT regulations the printing sector must comply because it handles the sale of services together with goods. In this blog, we will explore what is VAT in UK, what does vat mean in UK, how it affects printing services, and its application to common print products like estate agent signs and PVC banner printing.

Through UK tax laws, Value Added Tax (VAT) functions as an excise on the purchase of goods and services for final consumers. Businesses serve as conduits for VAT because it transfers ultimate financial responsibility to end consumers while businesses must represent the government for tax accounting purposes.

Private enterprises doing business in printing must handle VAT complexities. Printing organisations must establish if their sold products qualify for standard-rated taxation zero-rating or completely exempt VAT rules. You must understand the precise VAT rules affecting your printing operations to maintain compliance and make effective choices.

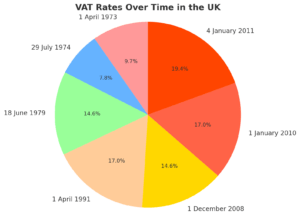

Understanding what rate is VAT in the UK is essential for businesses involved in or planning to use printing services. Understanding what percent is VAT in UK becomes crucial for all the respective service providers. As of now, Under UK taxation rules the standard VAT rate stands at 20%. Most goods and services like print products fall under VAT as well as every other good or service unless an approved exemption exists. (Source: UK gov)

The various products produced by the printing sector belong to different kinds of VAT classifications. Standard 20% Value-Added Tax applies to specific printing services but zero-rated and exempt printing options exist separately.

Under UK VAT legislation estate agent signs used as part of property sales or lettings operations qualify for zero rating. Nothing should be charged as VAT for these signs yet companies maintain the right to claim VAT for materials they use.

When it comes to taxational terms, it becomes intricate for new businesses to understand them. Knowing their true aspect would make the businesses aware of their revenue system accurately. Understanding what does zero rated VAT mean could be the game changer in claiming back your input taxes.

Under zero-rated VAT rules, businesses tax their products or services with a 0% rating. The product remains subject to VAT yet its rate is set at zero percentage. When businesses provide zero-rated products they retain the ability to recover VAT expenses which generates potential tax reductions.

Another important thing is to know, what items are exempt from VAT.

In the UK, some specific items and services are exempt from VAT.

Common examples include: insurance, financial services, and some healthcare services. Printed books, newspapers, and certain types of education-related publications may also be exempt from VAT.

Businesses involved in printing these exempt materials cannot reclaim VAT on the input costs associated with these products, unlike those dealing with zero-rated items like estate agent signs.

It becomes essential to distinguish zero-rated VAT from exempt VAT. Products and services under zero-rated VAT classification receive no VAT charges because they remain subject to VAT at 0%.

Criteria | Zero-Rated VAT | Exempt VAT |

VAT Rate | 0% | 0% (no VAT charged but outside the scope of VAT) |

Can VAT be Reclaimed? | Yes, businesses can reclaim VAT on inputs. | No, businesses cannot reclaim VAT on inputs. |

Products/Services Example | Estate agent signs, most food, books, children’s clothing | Financial services, insurance, certain education materials |

Taxable Status | Taxable, but the VAT rate is set to 0%. | Outside the scope of VAT entirely. |

Impact on Pricing | No VAT is charged to customers, but reclaimable on inputs. | No VAT charged and no VAT reclaimable. |

Applies to | Specific goods/services (e.g., print items like estate agent signs) | Specific exempt categories (e.g., insurance, health services) |

Invoicing Requirements | Businesses must issue invoices showing 0% VAT. | No requirement to charge VAT on the invoice. |

Content Disclaimer: The VAT rates provided are for general guidance and may be subject to change based on specific circumstances or updates to UK tax regulations. For the most accurate and up-to-date information, please contact us directly.

VAT’s default rate within the United Kingdom equals twenty per cent. Every product or service except those with approved reduced rates or exemptions must be taxed using the standard rate of 20%. Most print products including PVC banners, flyers brochures business cards and posters receive standard VAT rates within the printing industry.

Knowledge of the standard VAT rate allows print businesses to maintain tax compliance while providing accurate service pricing.

Selecting a printing company needs a detailed evaluation of VAT rules because their implications affect total costs for business and personal needs. Your print products’ total cost depends on the VAT rates together with exemptions applied to them.

For more detailed guidance on VAT in printing and how to approach a printing company, check out this blog: Things to Keep in Mind When Approaching a Printing Company.

The printing industry needs to navigate complex aspects of VAT regulations to follow legal standards while achieving maximum cost efficiency. Understanding VAT rates along with exemptions and rules will help you avoid undercharging or overcharging your VAT expenses in printing cases ranging from estate agent signs to PVC banner printing. Before ordering printed items consult your printer about their VAT status and review updates in VAT regulations.

Need VAT-Compliant Board Printing?

Ensure your print projects meet all VAT requirements—get in touch with the board printing company for hassle-free, tax-compliant printing solutions.

A digital and print specialist with over decades of experience ranging from design to production, Nimesh is committed to quality and working with clients to add value to their businesses. His technical knowledge of print machinery operation is matched only by his love of the print industry.

Jan 27 2025